Recently, Industrial Securities, in conjunction with Shanghai Securities News and China Financial Information Center, hosted the "New Opportunities: Embracing the Great Era of Equity" primary equity ecosystem conference for Industrial Securities' Family Wealth Office. The event brought together outstanding managers to build a platform for exchange and collaboration, look ahead to future trends, actively address new challenges, and uncover new opportunities!

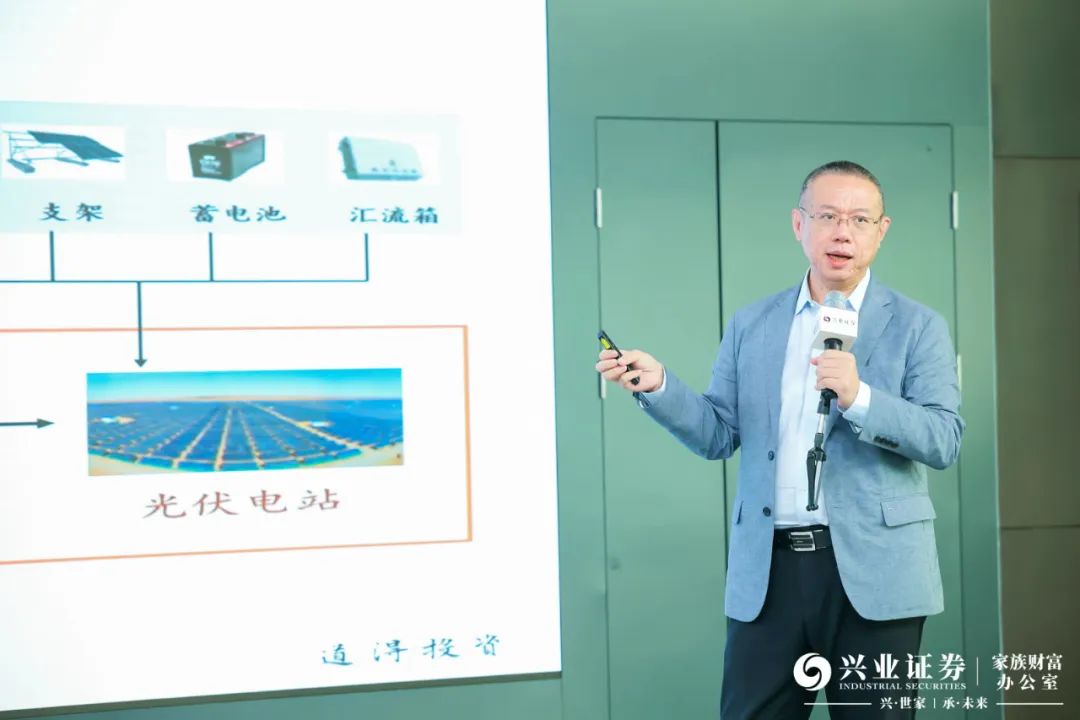

DDI, a private equity firm with RMB 10 billion under management specializing in the entire photovoltaic (PV) supply chain for eight years, saw its Chairman Wu Fei share insights based on a comprehensive consideration of the carbon neutrality backdrop, economic factors, and development potential. He posited that PV renewable energy is the future trend.

From the broader context of the era, in 2015, the United Nations Climate Change Conference adopted the Paris Agreement, aiming to limit global average temperature rise to within 1.5 degrees Celsius. Multiple global economies have committed to achieving carbon neutrality by 2050. In September 2020, China explicitly set targets for "carbon peaking" by 2030 and "carbon neutrality" by 2060, elevating these goals to a national strategic level.

Economically, according to the "Renewable Power Generation Costs in 2021" report by the International Renewable Energy Agency (IRENA), the global Levelized Cost of Electricity (LCOE) for PV has decreased by about 90% over the decade since 2010, significantly enhancing the economics of PV energy. It is projected that the global PV LCOE will further drop to USD 0.04/kWh in 2022, lower than the cost of coal-fired power generation. Moreover, China's PV electricity cost is below the global average, offering better value for money.

In terms of development potential, PV energy currently accounts for a small proportion of total electricity, indicating ample room for growth. In 2021, global PV power generation met only 3.7% of total electricity demand, with China at about 5%. As PV technology becomes more cost-competitive, PV has enormous potential to replace non-fossil energy sources.

Chairman Wu analyzed the PV renewable energy supply chain. Since 2021, due to supply-demand mismatches, silicon material prices have been rising, significantly increasing the gross profit margin of the silicon material segment. According to PV InfoLink, average prices of silicon wafers, cells, and modules in the main supply chain have shown a positive correlation with silicon material price increases but at a significantly lower and diminishing rate (increase: silicon material > silicon wafers > cells > modules). The upstream of the main supply chain has been squeezing downstream profits, with the final cost pressure falling on module manufacturers, leading to price negotiations between module suppliers and power plant operators. With the gradual release of expanded silicon material production capacity, downstream pressure is expected to ease, and profitability to recover.

Finally, Chairman Wu summarized investment opportunities in the PV industry, stating that we are undergoing an energy revolution and must seize the opportunities presented by the era. He is optimistic about PV in the next two decades, akin to the real estate market twenty years ago. However, unlike real estate, the demand for PV is global, with the world relying on Chinese PV modules. In the coming years, the entire PV industry may undergo reshaping of its competitive landscape. We hope to support better companies through this process, enabling them to grow over the next two decades.

During the Forum, Chairman Wu expressed the following views on topics such as the economic situation's impact on the primary market, perovskite, and silicon material shortages:

DDI focuses on the new energy sector, with 70% of China's investments in the top five tech sectors in the first half of the year going to new energy. Currently, the macro environment has little impact on the PV industry.

Perovskite has profound implications for the entire PV industry, as its conversion efficiency can be added to crystalline silicon, significantly boosting the conversion of light to electricity, making it revolutionary. China is currently in the research, pilot, and small-scale testing phases, slightly lagging behind overseas efforts. It is expected that perovskite will enter large-scale pilot testing within about five years.

The production ramp-up period for new silicon material capacity is about 18 months, with significant expansion expected to be released in the fourth quarter of this year and the first half of next year. Silicon material prices may see a downward turn in the fourth quarter, with sufficient supply by the first half of next year. However, with many companies still ramping up production, there will be ample silicon material in the fourth quarter of 2023 and the first half of 2024, and prices are expected to fall below RMB 100,000.